Business Performance

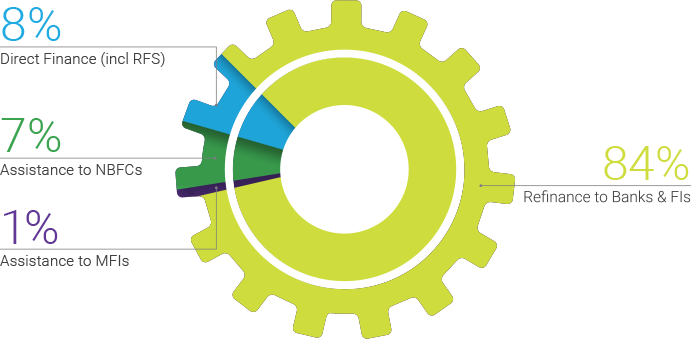

Portfolio composition FY 2021

Institutional Finance accounts for approximately 92% of total outstanding portfolio at the end of FY 2021.

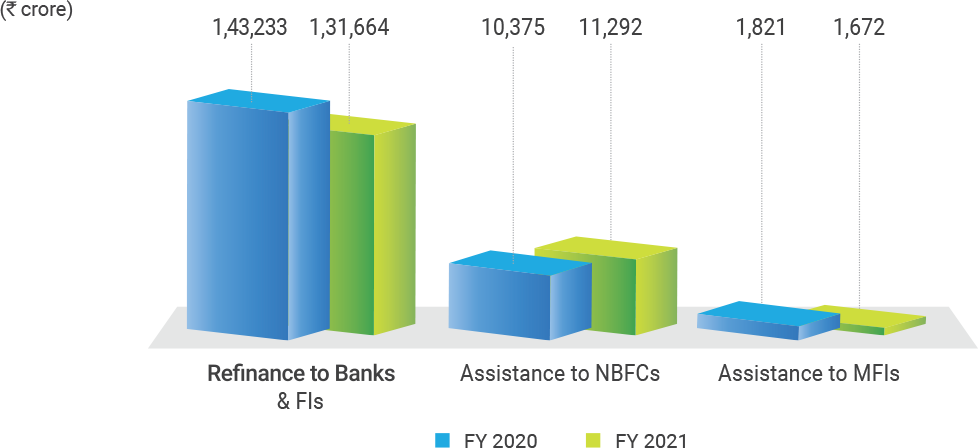

Outstanding portfolio under Institutional Finance stood at ₹1,44,628 crore at the end of FY 2021, a decline of 6.9% as compared to ₹1,55,429 crore at the end of FY 2020.

Composition of Institutional Finance

Refinance to Banks (including SFBs) & SFCs

- Portfolio outstanding stood at ₹1,31,664 crore as on March 31, 2021, a Y-o-Y decline of 8.1%.

- 31 commercial banks and 10 SFBs as live customers as of FY 2021.

- Cumulative disbursements under corpus allocated by RBI out of Priority Sector Lending shortfalls stood at ₹1,61,183.47 crore as on March 31, 2021, benefiting more than 24.69 lakh MSEs of the PLIs.

- During FY 2021, the Bank covered 686 districts through the network of its PLIs and disbursed ₹81,637 crore, generating employment of approximately 44.17 lakh heads. Out of which, ₹5,600 crore was disbursed in 109 aspirational districts and ₹25,989 crore was disbursed in 447 backward districts.

Assistance to NBFCs

- Assistance to NBFCs increased by 8.8% to ₹11,292 crore as of March 2021 from ₹10,375 crore as of March 2020.

- During FY 2021, the Bank onboarded 35 new NBFCs and the total number of live NBFCs as of March 2021 stood at 71.

- During FY 2021, disbursements to NBFCs (including to FinTech NBFCs) stood at ₹7,802 crore.

Assistance to MFIs

- As on March 31, 2021, the assistance to MFIs stood at ₹1,672 crore as on March 2021, a decline of 8.2% as compared to FY 2020.

- During FY 2021, disbursements to MFIs stood at ₹2,583 crore.

- The cumulative assistance disbursed under the Bank’s microfinance initiatives up to March 31, 2021 was at ₹20,568 crore and benefited around four crore entities.

- The Bank onboarded 18 new MFIs during the FY and total number of live MFIs as of March 2021 stood at 78.

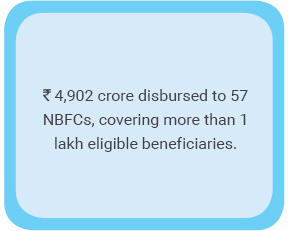

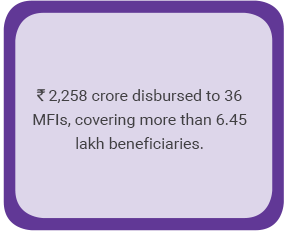

Under RBI SLF of ₹15,000 crore, the Bank focused on assisting lower rated NBFCs and MFIs to address the liquidity crunch. The position at the end of FY 2021:

RBI has provided SLF-II of ₹15,000 crore to the Bank, to address the liquidity & credit needs of MSME sector for FY 2022 and SLF-III of ₹16,000 crore, for innovative schemes to meet short and medium-term needs of the MSME sector, especially smaller MSMEs in credit-deficient and aspirational districts.

During FY 2021, the Bank focused on ensuring uninterrupted flow of credit to MSMEs, especially to those engaged in fighting the pandemic, and in implementation of relief measures announced by RBI.

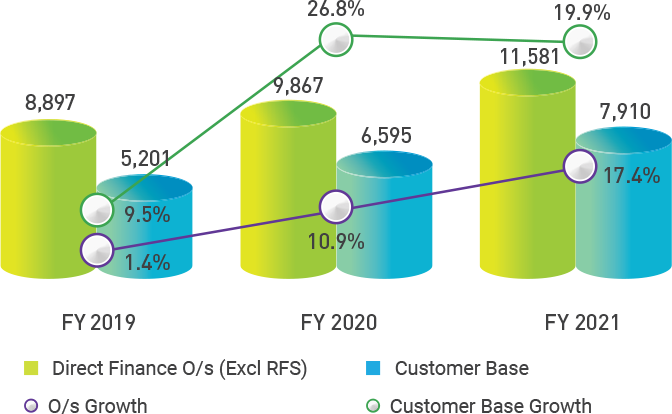

- Direct Finance portfolio outstanding (excluding RFS) stood at ₹11,581 crore as of March 2021, as compared to ₹9,867 crore as of March 2020, Y-o-Y growth of 17.4%.

- Disbursements during FY 2021 grew by 28% but sanctions have decreased marginally by 3.5%.

Direct Finance Portfolio

(₹ crore)

-

Tie-ups with OEMs/ Industry Associations:

Entered in Credit Delivery Arrangements with 58 Machinery Suppliers and six Industry Associations to accelerate credit delivery to MSMEs.

-

Promoting Renewable Energy Usage:

Entered in partnership with three OEMs in the solar power sector to give impetus to adoption of clean energy by MSMEs.

-

Launch of New & Quick Deliverable Products:

Sanctions and disbursements under new products during FY 2021 have been to the tune of approx. ₹2,900 crore (5,738 customers) and ₹2,522 crore (5,122 customers) respectively.

-

Financing Energy Efficiency at MSMEs - A World Bank project financed by Global Environment Facility (GEF)-

- Implemented in 26 clusters

- Loans extended under ‘End-to-End Energy Efficiency (4E) Scheme’

- Project rated as ‘Highly Satisfactory’ by the World Bank

- Green projects - The Bank, along with EESL, is implementing GEF, CTF and the World Bank-supported project PRSF, to transform the EE market in India.

- Accredited with the Green Climate Fund (GCF), set up within the ambit of UNFCCC.

- TIFAC-SIDBI (SRIJAN) Scheme and 4E schemes were continued during FY 2021 to support sustainable development.

- Introduced SAFE, SAFE-Plus & SAFE-WCTL to support MSMEs engaged in fighting pandemic at a subsidized interest rate of 5%, TAT of 48 hours. Under these schemes, ₹166.26 crore was sanctioned to 380 MSMEs.

- Special window under SMILE scheme for capex financing of items in the healthcare supply chain.

- Under TWARIT (ECLGS), ₹1,093.42 crore sanctioned to 2,840 customers as on March 31, 2021.

- As on March 31, 2021, 3,480 customers availed moratorium and 275 customers availed restructuring of their advances amounting to ₹617 crore.