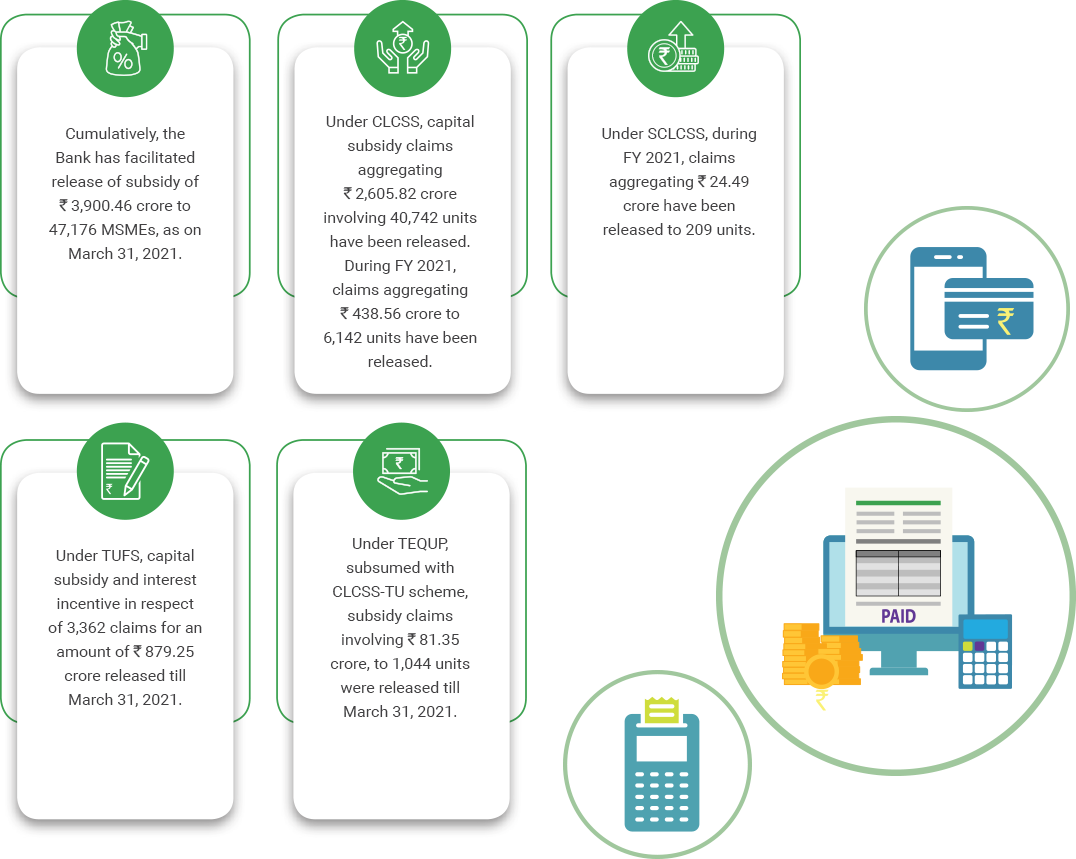

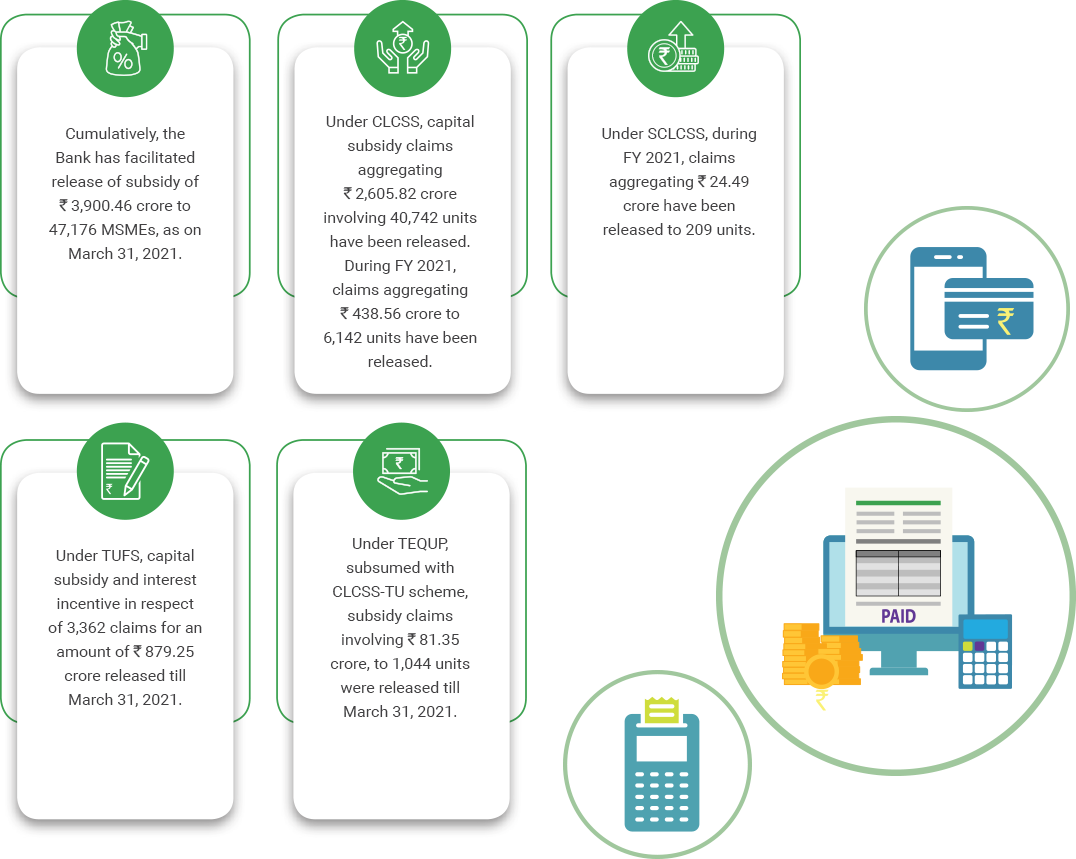

FACILITATOR ROLE

The Bank has been assigned the nodal agency role by the GoI for implementing various Government subsidy schemes, namely, CLCSS, TUFS, IDLSS, FPTUFS and TEQUP.

The Bank has been assigned the nodal agency role by the GoI for implementing various Government subsidy schemes, namely, CLCSS, TUFS, IDLSS, FPTUFS and TEQUP.